Prepare for the Future With Life Insurance

The Twianna Johnson Insurance Agency in Gary, IN, is here for the life insurance you and your family need. Life is unpredictable, and it's impossible to know what the future holds. That's why life insurance is so important. Life insurance provides financial security for your family in the event of your unexpected death. It ensures that your loved ones won't shoulder the burden of funeral costs and other expenses during a difficult time. Additionally, buying life insurance while you're young and healthy is a smart decision. It guarantees that you won't become uninsurable due to age or health issues. We also offer cancer insurance in case you are ever diagnosed with cancer.

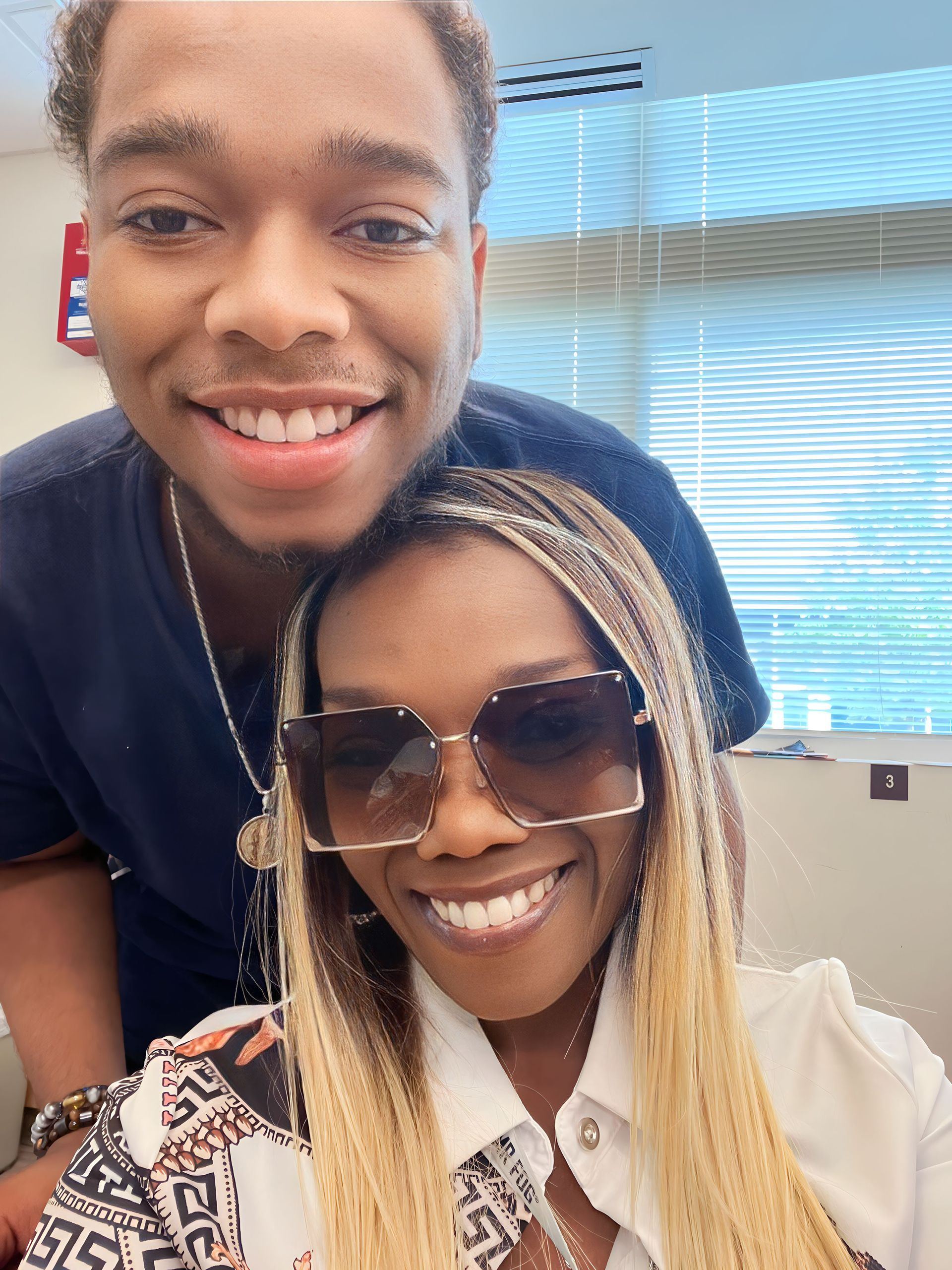

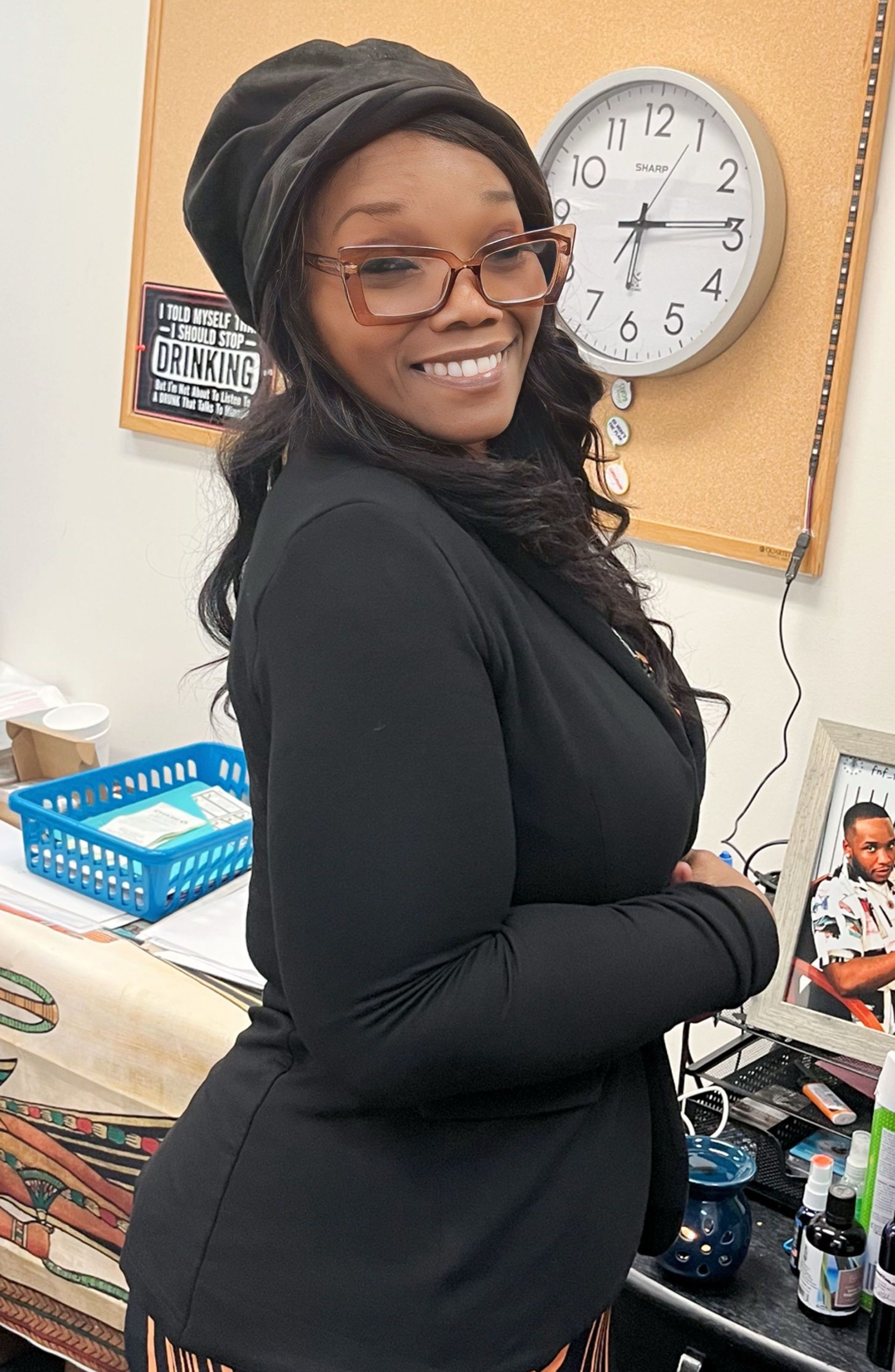

Less than perfect health? No problem. No medical exams are required for some carriers. Over the age of 70 and needing a burial policy or final expense policy? No problem. No medical exam is required for most carriers. We understand that thinking about life insurance can be daunting, but the insurance lady is here to guide you through the process and help you make the best decision for you and your family.

Benefits of Term Life Insurance

Term life insurance provides financial protection for a specific period of time. It is a cost-effective option for those who want to ensure that their loved ones are taken care of in the event of an unexpected death. The premiums are fixed for the policy term, and the death benefit is paid tax-free to the beneficiaries. This type of insurance can also cover mortgage payments, education costs, and other debts.

Benefits of Whole Life Insurance

Whole life insurance provides permanent protection, with a guaranteed death benefit and cash value accumulation. The premiums are fixed for the policy's life, and a portion of each payment goes towards the cash value. This type of insurance can cover final expenses and estate taxes and leave a legacy for loved ones. Additionally, whole life insurance can be a valuable asset, as the cash value can be borrowed against or used to supplement retirement income.

Benefits of Buying Life Insurance for Children

Purchasing life insurance for children can provide a financial safety net for the future. It can also lock in lower premiums and insurability for their lifetime. Unforeseeable health issues may arise, later down the road, your children may take an undesirable route in life and become uninsurable due to lifestyle. The monthly premiums will NEVER be lower than they are at that very time. All life Insurance is based on mortality. Additionally, some life insurance policies for children can build cash value, which can be used towards education expenses or other financial needs later in life. In the unfortunate event of a child's death, life insurance can also cover final expenses.

Let Us Help

Get information or ask for professional advice – call our team at 219-264-5601.